Compute the Standard Direct Labor Rate Per Hour

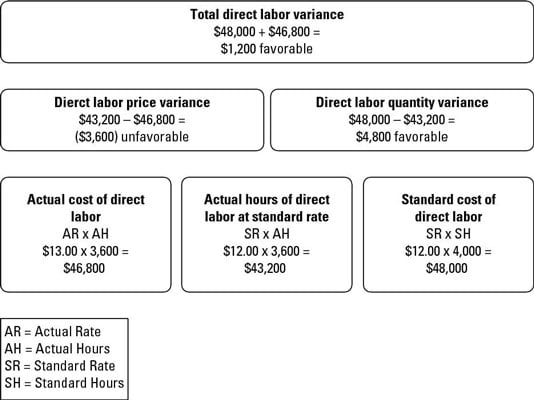

To compute the direct labor price variance subtract the actual hours of direct labor at standard rate 43200 from the actual cost of direct labor 46800 to get a 3600 unfavorable variance. Card A manufacturing company accumulates the following data on variable overhead.

How To Calculate Direct Labor Variances Dummies

Labor rate 040 per hour.

. Note that DenimWorks paid 9 per hour for labor when the standard rate is 10 per hour. A For contractors other than educational institutions and nonprofit organizations the cognizant Federal agency normally will be the agency with the largest dollar amount of negotiated contracts including optionsFor educational institutions defined as institutions of higher education in the OMB Uniform Guidance at 2 CFR part 200 subpart A and 20 U SC. No the FLSA does not require hazard pay.

Quantity 17280 - 35000 x 05lb x 1 lb 220 Favorable. Computing Hourly Rates of Pay Using the 2087-Hour Divisor Description. 4280 in rent for the manufacturing corporate office.

This result means the company incurs an additional 3600 in expense by paying its employees an average of 13 per hour rather than 12. For example if a forestry worker subject to a 900 per hour SCA prevailing wage rate is paid 1000 per hour 100 above the legally-required SCA prevailing wage rate of 900 and works 50 hours in a particular workweek the most that may be deducted from this workers wages for that week pursuant to a prior agreement covering specific. If you are a dual-resident taxpayer and you claim treaty benefits you must file a return using Form 1040-NR with Form 8833 attached and compute your tax as a nonresident alien.

FLSA generally requires only payment of at least the federal minimum wage currently 725 per hour for each hour worked and overtime compensation for each hour more than 40 worked in a workweek in the amount of at least one and a half times the employees regular rate of pay. I didnt receive my paper within the 6 hour window as requested however the person who worked on it requested an ext. Number of Jobs 2021.

For 2021 the standard mileage rate is 56 cents per mile. 3120 in marketing materials and ads. This subsection applies only to full-time employees described.

84000 - 83000 1000 Unfavorable. Beginning in 2022 the standard mileage rate increased to 585 cents per mile. The date of the most recent medical work release outlining the necessary work restrictions.

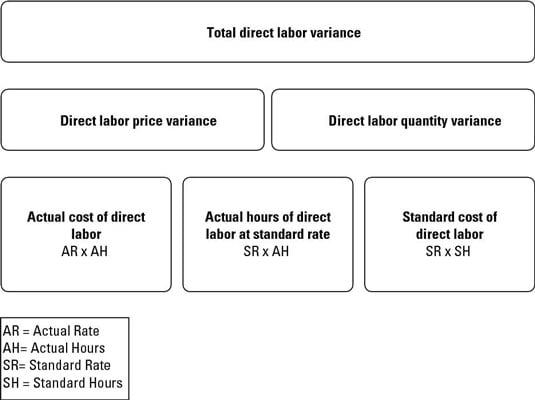

Labor rate 025 per hour. AH x AR 84000. The direct labor quantity standard is usually referred to as labor efficiency variance while the price standard is referred to as labor rate variance.

1 Little or no change. 129750 per year 6238 per hour Typical Entry-Level Education. Work Experience in a Related Occupation.

Hours worked 4000. Hourly and biweekly rates of pay for most Federal civilian employees are computed as required by 5 USC. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

65500 in salaries for production workers. A Every employee engaged on a piece-rate or regular hourly rate basis to labor on a farm shall effective January 1 2020 be paid not less than 1030 per hour or the minimum wage rate set by section 6a1 of the Federal Fair Labor Standards Act of 1938 29 USC. Biweekly rates of basic pay are computed by multiplying an employees hourly rate of basic pay by 80 hours.

At a resource cost of 3000 per hour this waiting would represent a cost of 30045 6000 per hour on the project. The effective date of the status will auto-populate with the date entered in the PER record ie. B For systems taking fewer than 40 samples per month under 1093013 the system has two.

Actual allocation base times times the standard variable rate. A dual-resident taxpayer may also be eligible for US. Then the average waiting time of any material load for u 56 is.

The gov means its official. Federal government websites often end in gov or mil. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

11350 in direct materials for the production of products. For the purposes of the FFCRA the amount of unpaid minimum wages does not refer to the federal minimum wage of 725 per hour but rather to the hourly wage at which the employer must compensate you for taking paid sick leave which is generally the greater of your regular rate or the applicable minimum wage federal state or local. AH x SR 83000.

Compute the labor rate variance. The Institute comprises 33 Full and 13 Associate Members with 12 Affiliate Members from departments within the University of Cape Town and 12 Adjunct Members based nationally or internationally. 24700 in salaries for the companys accounting team.

Cloud computing is the on-demand availability of computer system resources especially data storage cloud storage and computing power without direct active management by the user. Large clouds often have functions distributed over multiple locations each location being a data centerCloud computing relies on sharing of resources to achieve coherence and typically. A For systems taking 40 samples or more per month under 1093013 the system exceeds 50 total coliform-positive samples for the month.

We offer the lowest prices per page in the industry with an average of 7 per page. Get All The Features For Free. A company has a favorable direct labor.

Before sharing sensitive information make sure youre on a federal government site. Labor cost Standard hours for actual output x. Alternatively an institution of higher education as defined by Section 61003 Education Code may compute an employees equivalent hourly rate of pay for a given month by dividing the employees annual salary by 2080 which is the number of working hours in the standard work year.

SH x SR 85000. A standard cost _____ indicates the amount of direct labor direct materials and overhead for one unit of product. The pertinent question in the PER will only activate for cases in a PR or PN status since cases in a PW status already have a determined wage-earning capacity.

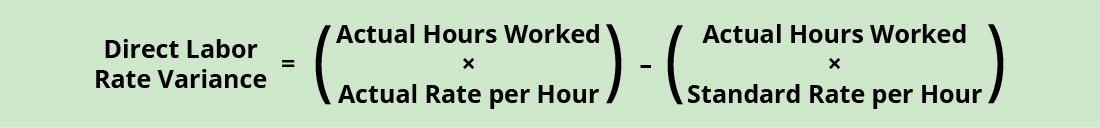

This 1 difference is multiplied by the 50 actual hours resulting in a 50 favorable direct labor rate variance. A _____ variance is the difference between the actual quantity per unit and the standard quantity per unit. If you are self-employed you can also deduct the business part of interest on your car loan state and local personal property tax on the car parking fees and tolls whether or not you claim the standard.

300 electric bill for manufacturing facility. In this example the arrival rate a equals 5 arrivals per hour and the service rate x equals 6 material loads per hour. The direct labor rate variance could be referred to as the direct labor price variance The journal entry for the direct labor used in the.

Direct Labor Standard Cost And Variances Accountingcoach

Direct Labor Standard Cost And Variances Accountingcoach

How To Calculate Direct Labor Variances Dummies

10 7 Direct Labor Variances Financial And Managerial Accounting

No comments for "Compute the Standard Direct Labor Rate Per Hour"

Post a Comment